Acquires hemostatic device manufacturer Biolife for $120 million dollars

Merit Medical Systems, a leading medical device company, has announced its latest acquisition, purchasing Biolife Delaware for approximately $120 million. This deal adds to Merit's growing portfolio and strategic pivot towards high-growth opportunities, particularly in the hemostatic sector.

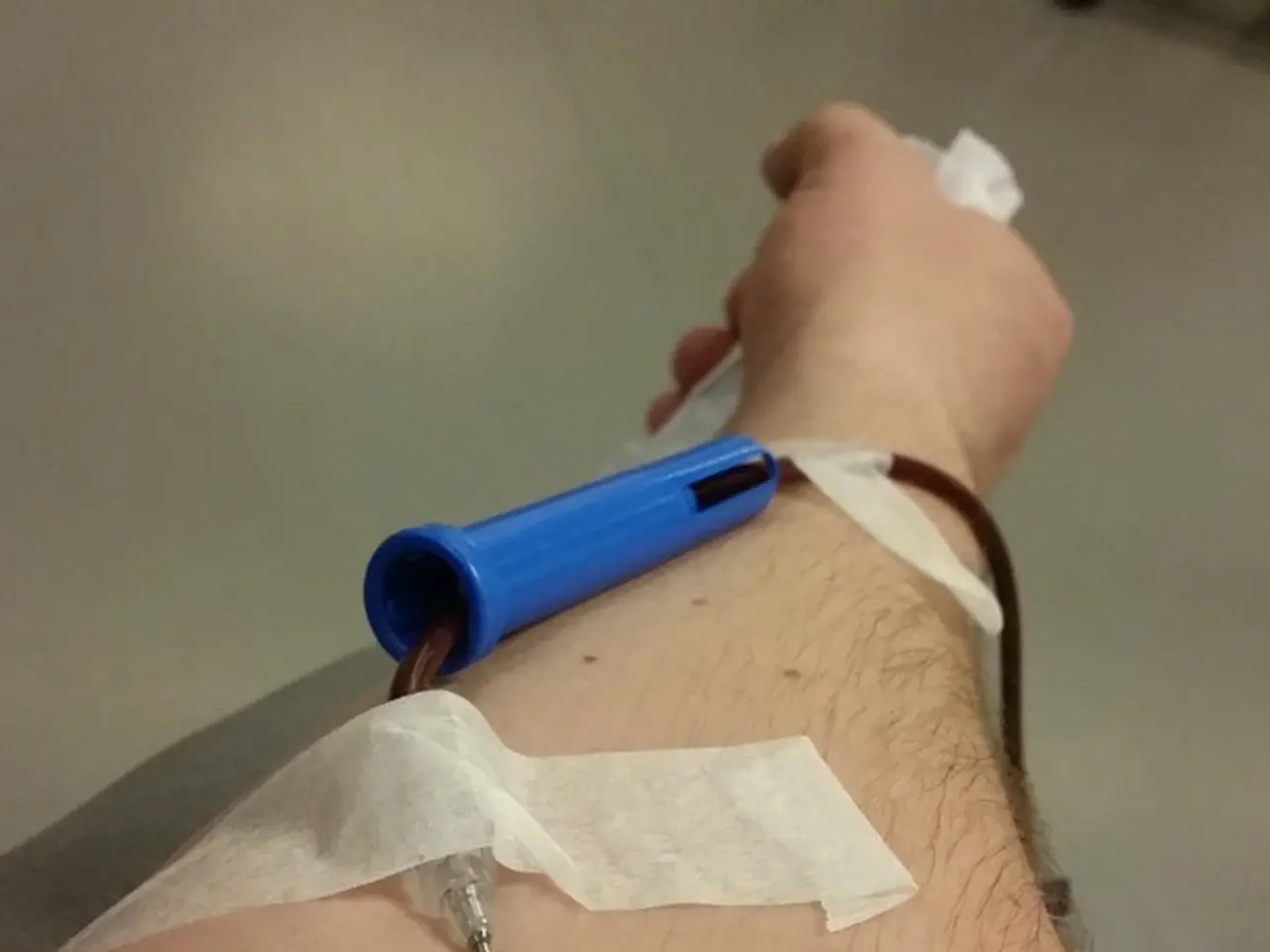

The acquisition covers StatSeal and WoundSeal devices, two products that address an estimated $350 million global market opportunity. StatSeal is a topical device that stops bleeding for up to seven days in 99% of cases, according to a study. WoundSeal, on the other hand, is an over-the-counter first aid product that instantly stops bleeding when applied and pressed.

Fred Lampropoulos, CEO of Merit Medical Systems, has not directly commented on the global market opportunity for StatSeal and WoundSeal devices. However, the acquisition aligns with Merit's strategy to expand into niche markets with high margins and minimal competition.

Needham analysts consider the deal to be consistent with Merit's strategy of pursuing tuck-in acquisitions of complementary products. J.P. Morgan analysts view Biolife as an attractive addition to Merit's portfolio, building upon Merit's efforts to expand into more innovative, therapeutic end markets.

Merit Medical Systems is forecasting mid-teens growth for StatSeal and WoundSeal. The company expects the acquisition to add about $18 million of revenue next year.

This acquisition is part of a string of deals by Merit, including the $210 million acquisition of Cook Medical's lead management portfolio and the $105 million purchase of an acid reflux device from Endogastric Solutions. In 2023, Merit also made a purchase of dialysis catheter lines for $132.5 million.

Lampropoulos stated there is a lot of activity in the marketplace with many companies remodeling their portfolios. Merit, he said, is actively engaged in looking for opportunities, as they always have been.

However, it's important to note that the article's title suggests potential unspecified conduct allegations against the Merit Medical president, which are not addressed in the available information.

As Merit Medical Systems continues to grow and acquire new products, it remains a significant player in the medical device industry, capitalising on high-growth opportunities and expanding into innovative, therapeutic end markets.

- Merit Medical Systems, boasting a leading position in the medical device industry, has announced its latest acquisition, Biography Delaware, for approximately $120 million.

- This acquisition encompasses StatSeal and WoundSeal devices, addressing an estimated $350 million global market opportunity.

- StatSeal, a topical device, promises to stop bleeding for up to seven days in 99% of cases, according to a study.

- WoundSeal is an over-the-counter first aid product that instantly stops bleeding when applied and pressed.

- Merit Medical Systems expects the acquisition to add about $18 million of revenue next year and forecasts mid-teens growth for StatSeal and WoundSeal.

- The deal aligns with Merit's strategy to expand into niche markets with high margins and minimal competition, as they seek more innovative, therapeutic end markets.

- This acquisition is one of several deals by Merit, part of a broader strategy that includes purchases of lead management portfolios, acid reflux devices, and dialysis catheter lines. Despite potential unspecified conduct allegations against their president, Merit continues to actively seek out opportunities to grow and innovate in the medical device industry.