Workers' Compensation and Medicare: Essential Facts to Understand

Cracking the Code on Workers' Comp and Medicare:

Getting hurt on the job can be a major hassle, especially when it comes to navigating the complex world of workers' comp and Medicare. But fear not, we've got you covered!

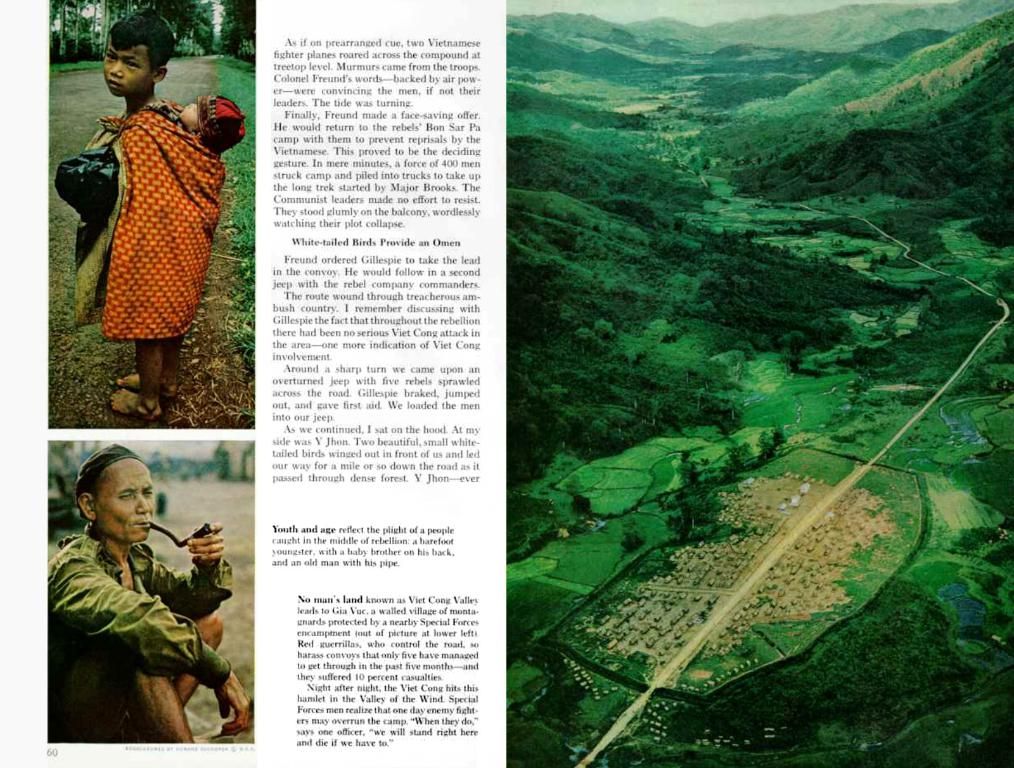

First up, let's define workers' compensation. Think of it as an insurance policy that's there to help out employees who suffer injuries or illnesses directly related to their job. The Office of Workers' Compensation Programs (OWCP) under the Department of Labor is the outfit responsible for this juicy benefit, which applies to federal employees, their families, and certain other entities.

Now, if you're already wrapped up in Medicare or anticipate joining its snazzy ranks soon, it's vital to comprehend how your worker's comp benefits might muddle with Medicare's coverage. Avoiding complications down the line is crucial to keep your medical bills under control for work-related injuries or illnesses.

So, just how does a workers' comp settlement blur the lines with Medicare?

Here's the lowdown. Under Medicare's secondary payer policy, workers' comp should pony up as the primary payer for any treatment linked to a work-related injury. But if expenses arise before you receive your workers' comp settlement, Medicare may loosen the purse strings first and initiate a recovery process facilitated by the Benefits Coordination & Recovery Center (BCRC).

But that's not all – the Centers for Medicare & Medicaid Services (CMS) generally keeps a close eye on the amount an individual receives from workers' comp for injury- or illness-related medical care to dodge the recovery process. In some cases, Medicare might decree the establishment of a workers' compensation Medicare set-aside arrangement (WCMSA) for these funds, and they'll only pick up the tab for medical care once all WCMSA funds have been splurged.

Now, which settlements necessitate a heads up to Medicare?

Workers' comp must punt the total payment obligation to the claimant (TPOC) to CMS. This represents the total amount of workers' comp earmarked for the person or on their behalf.

It's worth noting that if you're already slathered in the Medicare blanket based on your age or based on receiving Social Security Disability Insurance, and the settlement circulates $25,000 or more, you gotta submit a TPOC.

Additionally, if the person hasn't yet boarded the Medicare bus but will scoot over within 30 months of the settlement date, and the settlement spans $250,000 or more, you'll want to submit a TPOC as well.

Lastly, keep in mind that you must also spill the beans to Medicare if you submit a liability or no-fault insurance claim.

FAQs:

Haven't managed to lift the fog popping over your noggin? No worries! Glean answers to frequently asked questions by dialing 800-MEDICARE (800-633-4227,TTY 877-486-2048) or dropping by Medicare.gov during certain hours, where a live chat is also available. If you've got queries about the Medicare recovery process, the BCRC can be reached at 855-798-2627 (TTY 855-797-2627).

Is it compulsory to establish a WCMSA when your workers' compensation settlement exceeds the thresholds we mentioned? Nah, it's entirely voluntary. Nevertheless, if you fancy setting one up, your workers' comp settlement must be over $25,000 or $250,000 (if you're eligible within 30 months) to get started.

Can the scratch in a WCMSA be utilized for anything other than its intended purpose? Strictly verboten! Skirting the rules by mismanaging the funds can lead to claim denials and mandatory reimbursement obligations.

The Lowdown:

Workers' comp, that oh-so-sweet insurance for work-related injuries and illnesses for selected groups of people, needs a good acquaintance with Medicare to ensure your health bills remain in check.

Don't forget to educate yourself on how workers' comp may intermingle with your Medicare coverage to avoid future headaches with medical expenses. And as always, it's wise to keep Medicare in the loop about workers' comp settlements to avoid future claim denials and reimbursement obligations.

For further aid sifting through the maze of medical insurance, bop over to our Medicare hub [1].

Enrichment Data:

- Overall:A Workers' Compensation Medicare Set-Aside Arrangement (WCMSA) is a financial agreement that stows away a portion of a workers' compensation injury settlement to foot future medical expenses related to a work injury. This arrangement is essential to guarantee that Medicare keeps its mitts off medical care that should be covered by workers' compensation insurance, thereby preserving Medicare's interests.

How a WCMSA Plays Out:

- Purpose: The primary purpose of a WCMSA is to apportion funds from a workers' compensation settlement exclusively to future medical expenses that would otherwise be covered by Medicare. In doing so, it maintains Medicare as a secondary payer for these costs until the set-aside funds are depleted.

- Calculation: The amount allocated to a WCMSA is computed by approximating the injured worker's lifespan and calculating the future medical costs associated with the work injury. This process involves estimation of the type and frequency of medical services likely required throughout the worker's life.

- Management: The funds within a WCMSA are generally managed by the injured worker or a third-party administrator to ensure they are utilized only for medical expenses related to the work injury.

A Workers' Compensation Medicare Set-Aside Arrangement (WCMSA) is an essential agreement that sets aside a portion of a workers' compensation settlement for future medical expenses related to a work injury. This arrangement preserves Medicare's interests by ensuring that Medicare remains a secondary payer for these costs until the set-aside funds are depleted.

The amount allocated to a WCMSA is calculated by estimating the injured worker's lifespan and determining the future medical costs associated with the work injury. This process involves estimating the type and frequency of medical services that are likely to be needed throughout the worker's life.

Funds within a WCMSA are typically managed by the injured worker or a third-party administrator to ensure they are used only for medical expenses related to the work injury. Mismanaging these funds can lead to claim denials and mandatory reimbursement obligations.